What is the Forestry Mill Tax?

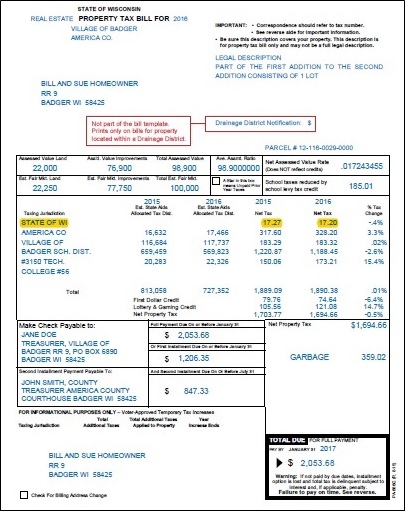

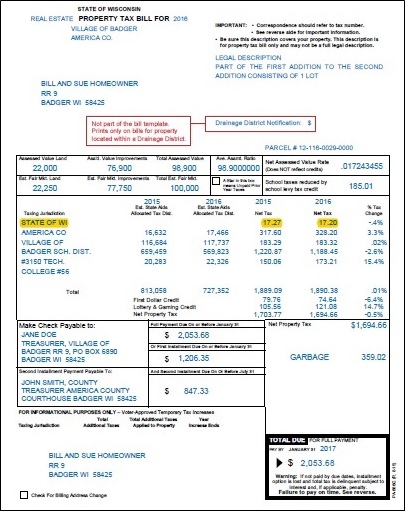

Ever heard of the forestry mill tax? Probably not, but if you’re a property owner in Wisconsin, this tax is collected with other property taxes every year. The forestry mill tax (FMT) as it’s commonly referred to shows up as the “STATE OF WI” on your property bill. This tax is the only property tax collected by the state with the total revenue being credited to the forestry account of the conservation fund in the state’s budget. An average Wisconsin home assessed at $150,000 pays $27 for the FMT or 16.97¢ per $1,000 of property value.

The FMT is not the only source of revenue to the forestry account. The forestry mill tax generated approximately $83 million in 2015-16 or 75% of the $111 million in revenues to the forestry account. The remaining $28 million comes from the sale of timber on state lands, stock from state nurseries, camping and entrance fees at state parks, some fees and payments associated with the Managed Forest Law, and a portion of the revenue from the sale of the conservation patron licenses. The purpose of the forestry account is to acquire, preserve and develop the forests of the state. In the past 87 years, this income has provided a stable and sustained funding source to provide financial, educational, and technical assistance to private woodland owners, manage pests and disease, control wildfires, clean-up natural disasters, improve recreational resources, and better our rural and urban forests.

FMT was first approved as an amendment to the state constitution in 1924 to help regenerate 17 million acres of forest cutover and burned in the late 1800’s. Today, these 17 million acres of forest (49% of Wisconsin’s land area!) support the wood products industry with an annual output of $24.7 billion, supporting 64,000 jobs and making Wisconsin the number one paper producer in the US. The continued funding through the FMT demonstrates Wisconsin’s ongoing commitment to provide a sustainable and harvestable resource, promoting industry, providing jobs, supporting tourism and conservation, all while benefiting Wisconsin citizens and their quality of life.

The future of FMT is currently up for elimination in the proposed 2017-19 state budget. To stay up-to-date on the status of FMT and other policies related to forestry, visit the Wisconsin Alliance for Forest Owners https://www.wiafo.org/