Long-term Planning

How can I protect my land long-term?

This content was originally published in our handbook for landowners, My Healthy Woods. Follow the link at the right to request a free copy.

As our landscape rapidly changes, more and more landowners are sensing that their land, and the stories and memories that go with it, may be lost. This is why many seek ways to protect their property legally in the long-term.

Land trusts can help you explore your options for ensuring that your land becomes your legacy.

What is a land trust?

A land trust is a non-profit organization that works toward the permanent protection of land and its resources for public benefit. These organizations offer local citizens a way to preserve areas that are important to the community and give individuals options for protecting their property.

Land trusts may accept donations of land, buy land, or help establish legal restrictions limiting development or undesirable uses.

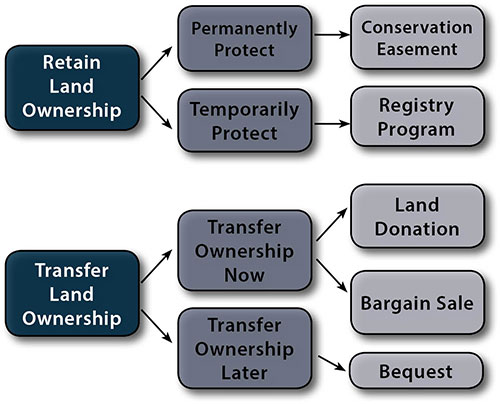

What types of land protections are available to landowners?

Conservation easements

Conservation easements are voluntary legal agreements that permanently restrict the way land can be used. Easements do so by separating some of the rights of land ownership, such as the rights to develop, subdivide, or mine, from the rest of the rights of ownership.

Those separated rights are effectively extinguished by being transferred to a non-profit land trust or a public agency committed to conservation. Easements may also be referred to as Purchase of Development Rights, as is often the case in farmland protection programs.

Each easement is crafted to meet the landowner’s individual needs and wishes for the land. Landowners retain the rights to own and sell eased property, but the easement restrictions will always be attached to the land title, remaining with the property forever.

Most conservation easements are donated to a land trust, and the donation can provide significant tax advantages. In some cases, easements are sold to land trusts or agencies, sometimes as bargain sales (see below).

Registry

If you are concerned with protecting the natural values of your land but are not ready to protect it permanently, you may want to consider registry. By registering your land with a land trust you make a commitment to protect the natural elements, features, and characteristics of your property.

You also agree to notify the local land trust before you plan to sell or transfer the property, but the protection will not be effective beyond your ownership.

Donating land to a land trust

If you are ready to give up ownership of your land, but want to make sure it stays protected, you may consider donating it to a land trust.

Caring about the land is one of the most compelling reasons to donate land to a land trust. But you may also choose to do so because you have highly appreciated property that would generate large capital gains taxes if sold; you have substantial real estate holdings and you want to reduce your tax burdens; or your land has become too great a responsibility and you want to be certain it’s managed and cared for by a group that appreciates its value.

Bequests

A bequest transfers ownership of property or an easement to a land trust through your will. It is a great choice if financial compensation is not a necessity and you want to maintain the current use of your land. A bequest may also be a good solution if your land has significant conservation value but there is no one to inherit it or the likely heirs cannot or will not protect it.

Land sales and bargain sales

While most land trusts have limited funding for purchases, it may be possible for them to raise money to purchase a particularly important piece of land. A bargain sale may be negotiated if you need some compensation for your property but can afford to sell it to a land trust at a price below what you could receive on the open market.

Thee difference between the maximum “fair market value” and the actual sale price is considered a donation to the land trust and is tax deductible.

Family estate planning

Learn the legal ins and outs of distributing your property during your life and at death. This Family Estate Planning in Wisconsin publication written by the Division of Extension at UW-Madison covers tools such as wills, trusts, and marital property agreements.